Mortgage In South Africa – Rates, Providers & Tips

Mortgages, popularly, hole loans in South Africa, are offered at varying rates depending on the nation’s economic state. A prime lending rate fluctuates with the shift in the economy. This is the value that every other lender in South Africa uses to give loans to its borrowers.

We will see how a change in the value of the prime lending rate affects the rates of every lender in South Africa. We will touch on the importance of knowing the current prime lending rate and how it will help a mortgage owner make calculated decisions.

South African mortgage rates are either fixed or adjustable. These rates have disadvantages and advantages, as we will show you. We will also show you how you can determine what rate you should go for and how it will affect your mortgage. The value of mortgage rates is different from one provider to another.

Home Loan Providers In South Africa

1. Absa Bank Morgage In South Africa

Absa Bank offers mortgage loans with a fixed interest rate of 7.5% annually for 1-20 years. The bank also offers adjustable interest rates that vary depending on the lending rate’s value during the borrowing period. A country’s economic shift may either lower or raise an adjustable interest rate. Below are other mortgage costs to consider when applying for a mortgage in Absa:

- Initiation service fee: The initial deposit to make the mortgage deal official.

- Monthly installments: These payments should be deposited until the agreement’s mortgage period ends.

- Insurance fee: This fee increases the bank’s trust in the borrower.

2. Capitec Bank Morgage In South Africa

Capitec Bank offers mortgage loans at a fixed interest rate of 7.6%-10% p.a. The period required for the loan to be paid back in complete is 1-20 years. The loan will be paid in monthly installments.

The fixed rates for mortgages in South Africa vary from person to person, depending on their credit score. Besides the credit score, the borrower’s trustworthiness is tested by how prompt they will pay the initiation service and the insurance fees.

Both are deposited to prove that you are worthy of mortgage loans. Adjustable interest rates also vary depending on the value of the primary lending rate. This will shift occasionally with changes in the nation’s economy.

3. Standard Bank Morgage In South Africa

Standard Bank offers mortgage loans at a fixed interest rate of 10%-11% p.a. You can get a mortgage loan and agree to pay it for up to a maximum of 20 years and a minimum of 1 year. During this period, equal monthly installments will be deposited until it ends.

The interest rates in Standard Bank increase as the house’s value increases. The mortgage agreement, however, is not the same for every borrower.

Whether a borrower’s record proves they are credit-worthy is crucial to the rate for a mortgage loan in South Africa. Variable mortgage rates are also available, which vary depending on the nation’s state of the economy.

4. First National Bank Morgage In South Africa

The First National Bank offers mortgage loans in South Africa at an average rate of 11%-12% p.a.. Their rates change with the change of the prime lending rate.

The prime lending rate has been rising in South Africa for years. This means that the rate of borrowing a mortgage loan in FNB Bank South Africa will keep growing. The prime lending value depends on the state of the nation’s economy.

For this rate to go down, the South African economy will have to improve, at least better than it is right now. FNB bank also offers adjustable rates that change as the economy changes. The best thing about a fixed interest rate is that it won’t be affected even if there is a shift in the economy.

5. SA Home Loans Morgage In South Africa

SA home loans offer mortgage loans for up to 30 years at an adjustable interest rate of 9%-12% p.a. on average.

The range of the rates in SA home loans is determined by examining whether the borrower is creditworthy. This can be done by looking at the borrower’s record. The borrower may be offered a fair interest rate if they have no history of loan evasion.

The house’s value determines the level of risk the bank takes. The more expensive a house is, the higher the risk. As a result, the mortgage of a high-valued house is given at high rates.

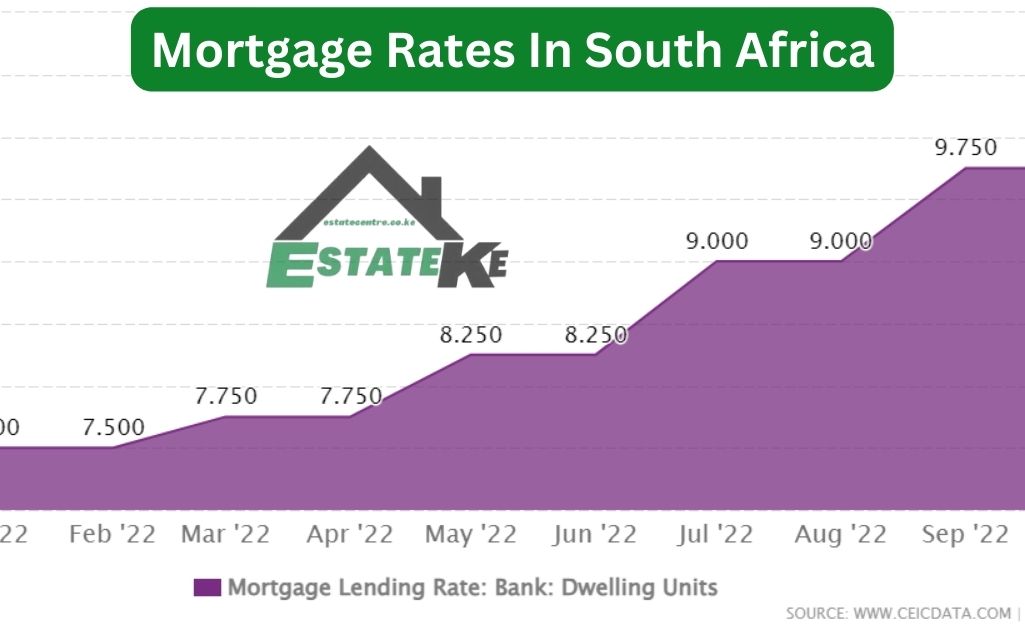

Mortgage Rates In South Africa

Mortgage rates in South Africa vary depending on the country’s economic state. The mortgage rate is determined by the value of the nation’s prime lending rate, which is the value that all small lenders use to offer loans to their clients.

Since the year began, the South African prime lending rate has increased as the days go by. At the beginning of the year, the prime lending rate was 10.75%; by May, it had risen by 1% to 11.75%.

Different lenders, however, have different rates. Below are the rates of the mortgage providers in South Africa:

| Mortgage Lenders | Mortgage Rates (p.a) |

|---|---|

| Absa | 7.5% |

| Capitec | 7.6%-10% |

| Standard | 10%-11% |

| FNB | 11%-12% |

| SA Home Loans | 9%-12% |

Mortgage (Home loan) Tips In South Africa

1. Choosing between fixed and adjustable mortgage rates

The borrower and the lender agree upon a fixed mortgage rate. The agreed rate will be about the current South African prime lending rate. Whether the prime lending rate increases or decreases, a fixed rate does not change during the mortgage period.

An adjustable mortgage rate is flexible such that it can either go up or down depending on the prime lending rate. When the prime lending rate goes up, it also does; when it goes down, it goes down too.

A fixed mortgage rate is the best option for 10 years or more long-period mortgages. Adjustable mortgage rates are favorable for short-period mortgages of 5 years and below.

The prime lending rate may increase tremendously over a long period, and the person who went for a fixed rate will not be affected. On the other hand, short-term period mortgages may have an advantage when the prime lending rate goes low.

2. Period of mortgage

When applying for a mortgage loan, you need a plan based on how long it will take to refund the loan. When doing this, you will have to consider the following:

- How secure is your job? This is very important due to the mandatory monthly installments. A long-term mortgage will be more manageable if your job is highly secure. The period has to be within the time before you retire. However, when you don’t have a steady source of income, for instance, a contract, you will negotiate for a short-term mortgage period.

- How is your health? With a good income in a secure job, you still have to consider your health. A short-term mortgage period is favorable for anyone with chronic illnesses and is the sole provider for a family.

- What is the value of the house? A high-value house is easier to pay over a long period. Before opting for such a house, you must ensure you can earn monthly payments for every month during the mortgage period.

3. House value and how it affects rates

Houses of high value increase the level of risk for the lenders. This means that if anything goes wrong, they will lose a lot of money in the process. Due to that fact, lenders have high-interest rates for high-valued houses to reduce the level of risk. They also look through your history of taking loans to verify whether you are credit-worthy or not.

Even after proving that you can repay the credit, the lender will have to ask you for an insurance and service initiation fee, just to be specific.

Therefore, getting a mortgage with medium or low value is easier. The risk is low, so you will be offered medium to low rates on your mortgage.

Mortgage Laws In South Africa

1. You have to be of legal age to apply for a mortgage loan

To be approved for a mortgage in South Africa, the law requires that you be of 18 years or above. This is the South African legal adult age when citizens are considered independent in their actions.

You will need to be of legal age to qualify and prove with a national identity card.

2. The South African Reserve Bank vets a foreigner to get a mortgage

Foreigners are not barred from getting mortgages in South Africa. A foreigner can apply for a mortgage, but the approval process will differ.

They first have to be approved by the South African Reserve Bank. A foreigner is vetted to ensure that you have a source of income. Providing identity documents is necessary to find a foreigner’s credit history.

3. A borrower’s credit history should be clean to get a mortgage

A borrower can only be approved for a mortgage once the bank proves they can trust them to pay in due time. This is figured out by looking at your credit history.

If you have failed to pay for a loan, your chances of being approved for a mortgage are minimal.

4. The borrower has to confirm their identity

The law allows the bank to access a borrower’s details to avoid fraudulent borrowers. The bank will ask for your most important documents, such as your national identity. They then counter-check with specific offices to confirm if the documents are legitimate.

5. A borrower should have a reliable source of income

A mortgage is mainly paid back by the bank, taking a percentage of a borrower’s salary at the end of every month until it is settled.

As a result, the bank will ask for proof of a reliable income that will last during the mortgage period. The bank then talks to a borrower’s employer to confirm whether the documents are legitimate.

6. Failure to follow the mortgage terms of the agreement will have the house repossessed

The bank can repossess the property if you fail to pay the monthly mortgage on time. The amount of grace period before repossessing the property varies from bank to bank. It also varies from borrower to borrower depending on the terms of the mortgage agreement.

Types Of Morgage In South Africa

There are three types of mortgages in South Africa which are classified according to the interest rate:

- Variable mortgage loans: These are mortgages with adjustable interest rates. When the Central Bank’s interest rate goes up, they do too.

- Fixed mortgage loans: These are mortgages that maintain the interest agreed upon for the rest of the mortgage period.

- Interest-only mortgage loans are paid by completing the interest first and then agreeing with the bank to cover the rest.

FAQs

7.5%-10%. With the prime lending rate increasing to 11.75%, lenders offering mortgages at a fixed interest rate of 7.5%-10% are being fair to their clients. Most mortgage owners who get such a rate are the ones that applied before the 2020s. The prime lending rate has increased, forcing lenders to raise their rates.

7.5%-12% fixed rate, depending on the mortgage provider. The following are the rates of the best mortgage providers in South Africa:

1. Absa: 7.5% p.a.

2. Capitec: 7.6%-10% p.a.

3. FNB: 11%-12% p.a.

The current prime interest rate in South Africa is 11.75% p.a., as reported in May. This rate has increased by 1% since the year began. In January, the rate was at 10.75%. This value is essential because it is the optimum rate lenders use when giving out loans. With the rate increasing, getting mortgages becomes more challenging due to the high-interest rate.

Absa bank and Capitec bank. Absa and Capitec Bank give out loans at an interest rate of 13.75%. Compared to other banks in South Africa, this is a very fair rate. The interest rate has gone up compared to the previous years. The reason behind this is the increase in the prime rate, the optimum value bankers refer to when giving out loans.

7.5% p.a. Absa Bank offers this mortgage rate. They give mortgages at 7.5% p.a. as their lowest rate. The fixed mortgage rate varies depending on the value of the prime rate. When it goes up, lenders have to adjust their fixed rates. This does not include the people who have ongoing mortgage loans.